December 26, 2024

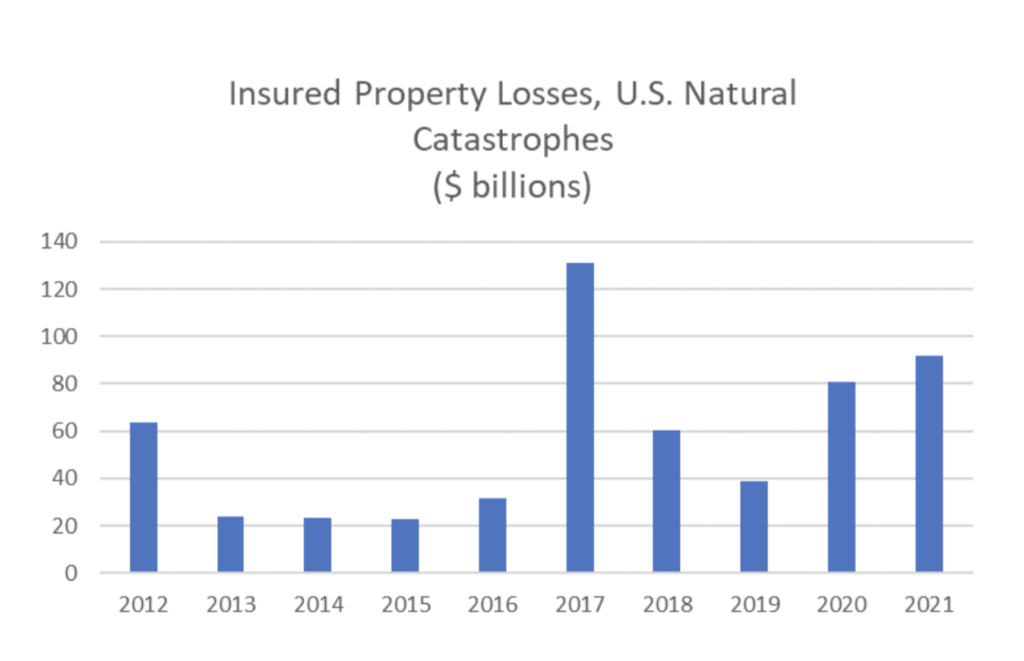

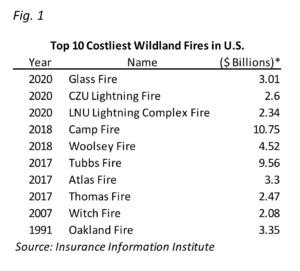

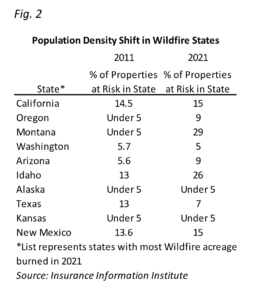

At BCU Risk Advisors, we’re dedicated to safeguarding the legacies of successful individuals and families. The personal insurance landscape continues to evolve, with rising costs, emerging threats, and shifting market dynamics shaping the way we manage risk. As we look ahead to 2025, our commitment remains the same: to deliver proactive, customized insurance solutions tailored to our clients unique needs. Key Trends in 2025 1. Rising Costs and Market Adaptations Premium Increases: Homeowners (+10-12%), Auto (+8-10%), and Umbrella (+10-15%) premiums continue to rise, driven by inflation, labor costs, and social inflation. Capacity and Creative Solutions: Insurers are reducing coverage in high-risk areas, while non-admitted (E&S) markets are stepping in to offer innovative alternatives. Higher deductibles and self-insurance are also becoming common strategies. 2. Emerging Risks Cyber Threats : With global cybercrime costs projected to reach $10.5 trillion by 2025, affluent families face growing risks, from ransomware to identity theft. Natural Disasters: The increasing frequency and severity of hurricanes, wildfires, and flooding call for enhanced disaster preparedness and specialized coverage. Liability Exposures: Social inflation continues to drive increased payouts for lawsuits, making robust umbrella policies critical. 3. Specialized Coverage Needs High-Value Collectibles: Proper valuation and protection for items like fine art, rare wine collections, and antiques is more important than ever. Travel Risks: International travel brings exposures like theft and medical emergencies, highlighting the need for tailored travel insurance solutions. 4. Generational Wealth and Estate Planning Federal Tax Changes: With estate tax exemptions set to drop in 2026, families must prepare for potential impacts on wealth transfer strategies. Educating Heirs: Younger generations require guidance in risk management to ensure their legacy is preserved. BCU Risk Advisors: Your Trusted Partner in Risk Management Comprehensive Coverage Tailored to You We specialize in creating customized insurance solutions that reflect unique lifestyle, assets, and goals. From safeguarding high-value homes and collectibles to protecting against liability exposures, our strategies are designed to evolve with our client’s needs. Proactive Risk Management By emphasizing prevention, we help our clients avoid claims before they occur. This includes installing water shut-off systems, disaster-resistant landscaping, and utilizing advanced cybersecurity measures. Collaborative Approach We work closely with wealth managers, estate planners, and legal advisors to integrate insurance seamlessly into our clients broader financial strategies, ensuring assets and legacies are fully protected. 2025 Recommendations for Families 1. Annual Policy Reviews: Regularly review your policies to address new exposures, lifestyle changes, and market shifts. 2. Invest in Risk Mitigation: Measures like installing leak detectors and upgrading cybersecurity systems can reduce risk and improve insurability. 3. Enhance Coverage: Robust umbrella policies, flood insurance, and cyber coverage are essential for comprehensive protection. 4. Prepare for Wealth Transfer: Engage experts to navigate tax changes, ensure accurate valuations, and educate heirs on managing inherited assets. Why BCU? Our relentless focus on service, risk mitigation, and relationship building has earned the trust of over 1,500 families across all 50 states. By leveraging our carrier partnerships, we consistently deliver comprehensive coverage at competitive rates. Conclusion As 2025 unfolds, the personal insurance market will continue to challenge and evolve. With BCU Risk Advisors by your side, you and your clients can face these changes with confidence, knowing assets are protected, risks are mitigated, and families are secure. Contact us today to learn how we can support your personal insurance needs and help you navigate the year ahead.